Before investing in debt mutual funds, know the tax impact on your income.

As per the existing provision of the Income Tax Act, on redemption of debt mutual funds held by you for three years or more, they are considered long-term capital gains, can avail of the indexation benefit, and are taxed at a flat rate of 20% after indexation or 10% without indexation. On the contrary, if your holding period in a debt mutual fund is less than three years, any gain that arises on redemption is taxable at the investor's tax slab rate. But, in the Annual budget 2023, any capital gain on redemption of debt funds purchased on or after April 1, 2022, will be taxed as per the income tax slab rate applicable to your income. Therefore, it can help you defer taxes. Like FDRs, now you must pay…

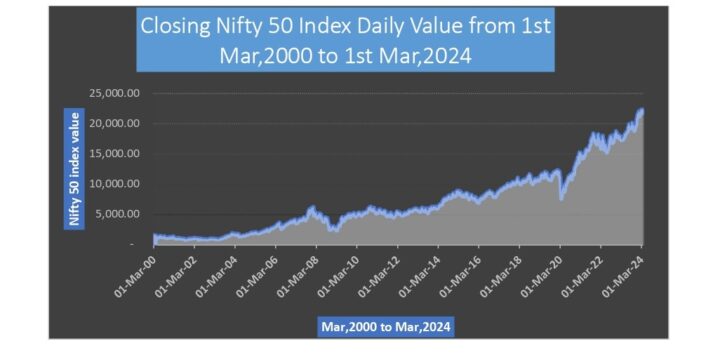

Be greedy when the market is selling and fearful when the market is buying.

What should you do in the chaotic market? The market is always based on the concepts of Fear and greed; these concepts are based on human emotions and euphoria. Everyone is selling out of acute anxiety in a bear market if the stock price declines during a market crash or correction. At that point, you believe the market offers you a chance to purchase. Added fundamentally sound stocks to your portfolio that you could not buy earlier owing to excessive valuation. The Fear & Greed Index can be a useful technique to gauge market mood when used in conjunction with fundamentals and other analytical tools. The Fear & Greed Index determines the market's state of mind. Fear and Greed sentiment indicators can help investors recognize their emotions and assumptions,…

Challenging year for India to sustain Annual Growth FY 2022-23

The Eagle Eye- page 26- March 2022 The Eagle Eye -page -17, March 2022 The Eagle Eye- Page 28, March '2022

Why Succession Plan is necessary for Financial Planning?

“Succession & legacy plan protect your property in case of any eventuality or due to the circumstances which are beyond your control. Otherwise, your property gets distributed equally among your heirs according to the succession laws in place of a perfect will.”

National Pension System(NPS)

My article has a special feature in Bhartiya Rail(भारतीय रेल) Magazine.

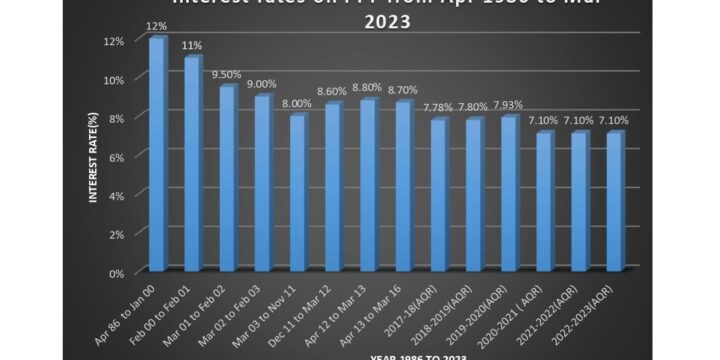

SMALL INVESTMENT OPTIONS FOR INDIVIDUALS

My article "Small Investment Options for Individuals" has a special feature in Reader's Trail, Magazine-August Issue. If you need any support for portfolios allocation, get in touch with me, and I will help you as best I can.

How Coronavirus is affecting the Social & Financial Scene?

The complete lockdown because of the outbreak pandemic creates unprecedented unemployment, uncertainty in the market, and all the business activities, especially in unorganized sectors in India. Imagine the U-shaped recovery of recession, which is the best option for India.